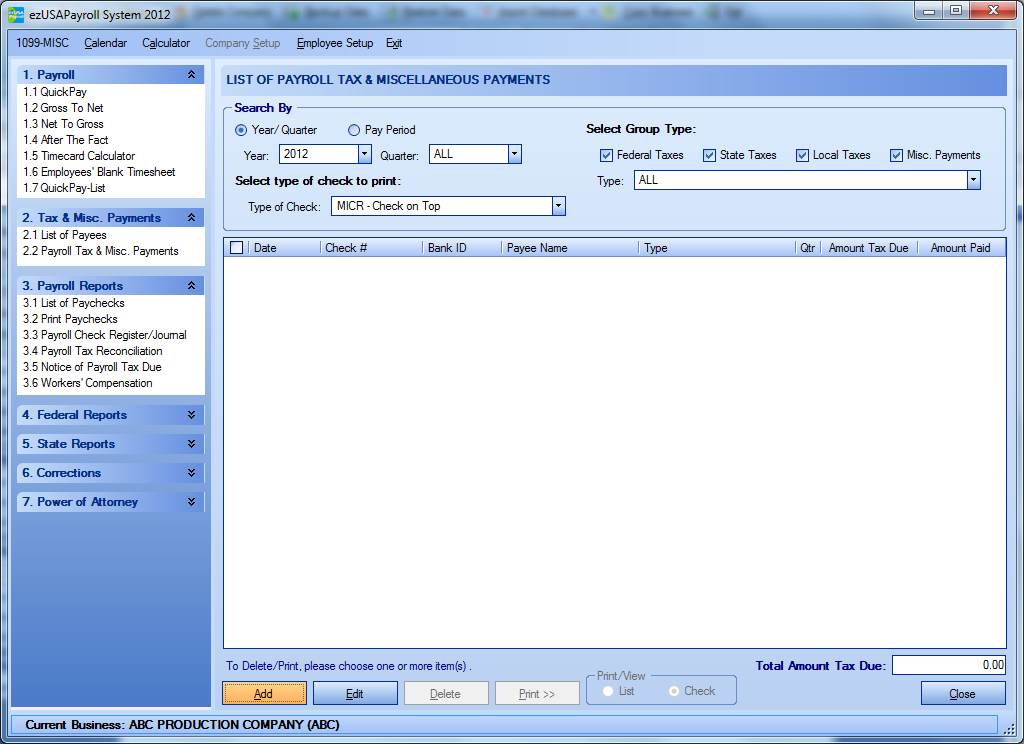

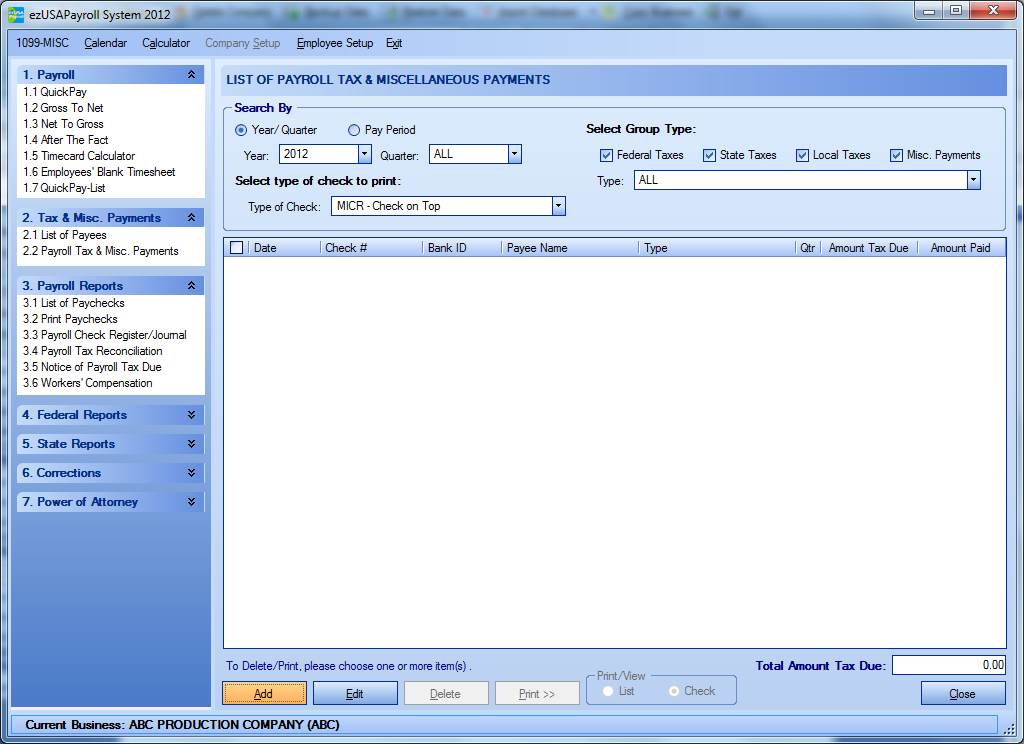

PAYROLL TAX & MISC. PAYMENTS

Click 2.2 Payroll Tax & Misc Payments.

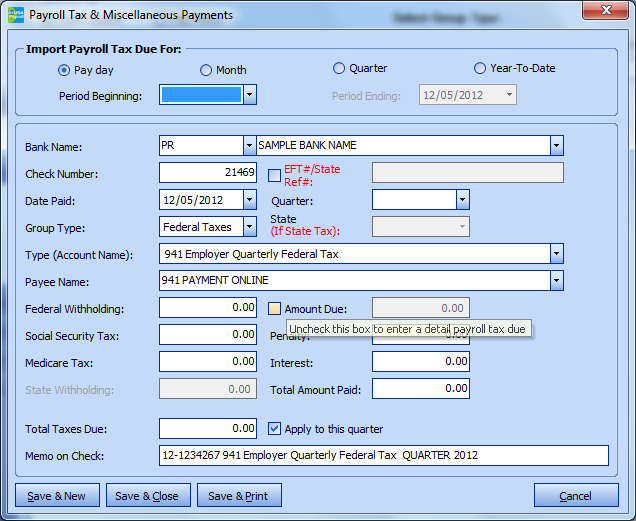

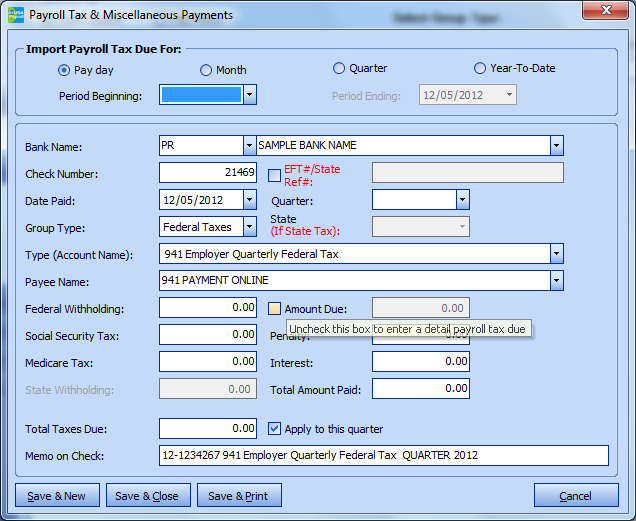

To create a new payment, click Add.

- Bank Account: Select the checking account the tax deposit is to be written from.

- Check Number: The program displays the next available check number. It may be overwritten.

- Year: Enter the tax year.

- Quarter: Enter the quarter the payment applies to.

- Date Paid: Enter the date of the check.

- Group Type: Select one of 4 groups: Federal Taxes, State Taxes, Misc. Payment, and Local Taxes.

- State: Select State if Group Type is State Taxes.

- Type: Select Type of Tax you want to pay. It may be overwritten.

- Payee: This may be selected from your Payee List. It may be overwritten.

Enter check amount: there are two options:

- enter amount of each type of taxes due or

- enter one lump sum amount for Amount Due.

Memo on Check: Enter memo for this payment.

This field is optional and will appear on the face of the check.

Click Save & Close to save all.

Or Click Save & Print to save and Print check.

To change a Payment, select a Payment on the grid and click Edit.

To delete/print, check mark one or more Payment(s) then click Delete/Print

Created with the Personal Edition of HelpNDoc: Free PDF documentation generator